Draft Regulation 18 Sandwell Local Plan

Great Bridge

9.189 Great Bridge is the main town centre in Tipton and makes up one of its three wards. The population of Tipton in 2021 was 44,125, making up 12.9% of Sandwell's total population. Of this total, 19% of Tipton's population are from ethnic minority backgrounds.

9.190 The population profile of the town in terms of age structure is very similar to that of Sandwell overall. The main difference is a slightly larger proportion of residents aged under 16. Tipton also has the lowest number of people aged 65 and over of any part of Sandwell.

9.191 Tipton's Income Deprivation Affecting Children Index and Income Deprivation Affecting Older People Index Scores put it in the 20% most deprived areas in England for both indices.

9.192 Healthy life expectancy was statistically and significantly lower than the average for England in all three wards in Tipton. Healthy life expectancy for both women and men was lower than the present state pension age (66) in all three wards and when compared to the average in England; this suggests that people may not necessarily be healthy enough to work until the state pension age.

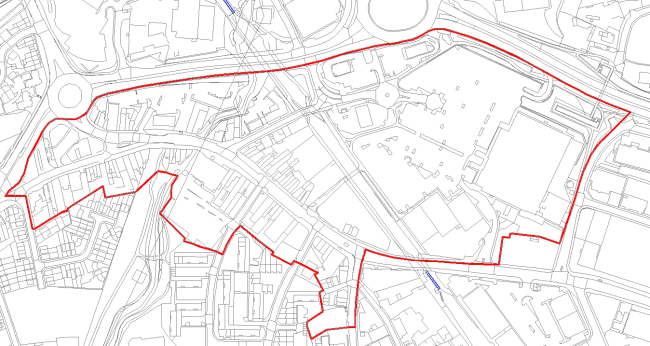

Figure 9 - Great Bridge Town Centre

© Crown copyright and database rights 2023, Ordnance Survey Licence No AC0000824500

(1) Retail and Town Centre Uses

9.193 The centre is currently designated as a town centre in the Sandwell Local Plan. The current boundary of the centre accurately reflects the extent of the retail area and does not require consolidation.

9.194 The town centre designation does include Great Bridge Retail Park. Whilst the retail park and the main centre operate independently, there appears little benefit in removing the former from the Town Centre boundary. However, better integration between the two elements is required for the retail centre to truly form part of the town centre.

9.195 There is no Primary Shopping Area boundary currently defined, and it is not recommended that one is needed, as the role of the centre is primarily in retail use across all areas.

9.196 Great Bridge currently has 86 commercial units with a total floorspace of 13,850m2. 2009 data appears to include Great Bridge Retail Park as well, which is not included within the 2019 GOAD data[162]. As such, a comparison of the number of units and their floorspace over the past ten years is not directly available. However, the 2009 study recorded 90 units; it is likely that this comprised 86 units in the traditional centre and four in the Retail Park, meaning that the traditional centre has remained the same size. Two drive-through restaurants have been added to the retail park in the interim (these were not mentioned in the 2009 report). In 2009 there were four vacant units and there are now five vacant units. Therefore, the centre has remained generally consistent in size and stability in terms of the level of vacancies over the last ten years.

9.197 The various commercial uses in Great Bridge are evenly spaced through the centre with no clear patterns or grouping. The units themselves are typically small (<160m2) and are grouped in terraces, occasionally broken by larger stores, lanes, or empty areas. There are very few community uses within or near to the centre, with only a library and medical centre in evidence. There are seven main national multiples (excluding the Retail Park), which are evenly distributed around the centre (these include a Lidl store and various bookmakers).

9.198 Comparison goods retailers occupy 20% of the centre's units, well below the UK national average of 36%. When comparing floorspace, comparison goods make up 32% of the centre's total, which is the same as the national average. This level of comparison goods is above average when compared to nearby town centres, suggesting a stronger market presence. Convenience goods account for 15% of Great Bridge's commercial units, which aligns with the national average; however, the floorspace of these units makes up 21% of the centre's total, which is 12% above the national average. This over-representation of convenience goods can mostly be attributed to the relatively large 1,380m2 Lidl store, which represents 48% of all convenience floorspace in the centre. Again, this high level of convenience floorspace is typical for such town centres, which tend to have one or several large floorplate supermarkets.

9.199 The floorspace levels of retail services are below the national average, at 11% compared to 14%. However, in terms of number of units, levels of retail services are higher than average at 22% compared to 7% nationally. This shows that there is a high volume of small floorplate retail service units, a trend throughout most local town centres. 11 of these 18 units are hairdressers.

9.200 Leisure services closely align with the national average, with the number of units making up 28% of the centre's total (3% above average), and the floorspace totalling 21% of the centre's total (3% below average). These levels are above average when Great Bridge is compared to other town centres and suggest a comparably healthier leisure market. However, it is worth noting that 50% of these leisure services are takeaways; this limits the evening economy-generating uses to the three restaurants in the centre.

9.201 In accordance with Hot Food Takeaway Policy SDM6, the threshold for Great Bridge Town Centre is 7% and as of 2023 there are seven hot food takeaways in the centre, representing 7.69% of the total number of units. Therefore, Great Bridge is over the threshold for the number of hot food takeaways in the town centre.

Facilities Provision

9.14 There are very few community uses within or near to the centre, with only a library and medical centre in evidence.

(1) Accessibility

9.202 Although there are no new transport proposes for Great Bridge itself, the centre will benefit from the Wednesbury to Brierley Hill Metro line.

9.203 The centre is dominated by road traffic, to the significant detriment of pedestrian movement. Pavements vary from being wide (i.e., outside Lidl) to narrow (around Market Place) and sometimes pedestrians must contend with cars parked on the pavement. The roads, in addition to being busy with traffic, are also relatively narrow and there is no cycle infrastructure, making the centre difficult to access for cyclists.

9.204 Crossing the road is only possible at signalled pedestrian crossings, which are relatively far apart (there are four within the centre). They are generally well-located; one aligns with the footbridge to the retail park, and one with the market, although the crossing to Aldi is more difficult, being a staggered and indirect one.

9.205 This level of inconsistency and lack of provision makes the centre particularly difficult to access for those with disabilities. The footbridge provides a direct, though unappealing, link to the retail park, though this is DDA accessible.

9.206 Dudley Port Rail Station is 0.6m west of the town centre and the nearby Black Country Route provides access to both the M5 and M6 motorways.

Accessibility – Provision for cyclists

9.207 There are several proposed SCWIP routes - CR 3, CR 14 and a West Midlands LCWIP route from Burnt Tree to West Bromwich via Great Bridge and Carters Green.

Environmental Quality

9.17 The environmental quality of the town centre is generally poor, with most of the shop frontages in need of significant maintenance and modernisation. Despite having a lower than average number of vacant units (proportionally), the low quality of the occupied properties makes the area feel like it is in a state of decline, despite figures suggesting otherwise.

SWOT

9.208 The Centres Study Health checks noted the following characteristics for Great Bridge:

|

Strengths

|

Weaknesses

|

|

Opportunities

|

Threats

|

Aspirations

9.209 The health checks identified that there is limited evening activity due to the lack of leisure facilities around Great Bridge, including the strict definition of leisure as well as restaurants.

9.210 Opportunities for funding to improve shop fronts and townscape quality should be investigated. Generally, frontages within Great Bridge are in a poor condition, which may adversely affect its attractiveness to potential new occupiers or for new development / investment.

9.211 There should also be opportunity to provide improved public and active transport, to provide more cycle lanes.

[162] Experian's GOAD plans show the fascia name, retail category, floor space and exact location of all retail outlets and vacant premises. Key location factors such as pedestrian zones, road crossings, bus stops and car parks are also featured.